How to fill the Biotech Talent Void

Recruiting the right talent was ranked as the top concern of CEOs according to a recent Harvard Business Review piece. The 20th annual PWC CEO survey cited human capital as the number 2 biggest challenge surpassed only by innovation. For many life science, biotech and pharmaceutical companies, finding suitable talent is a prospect of binary opposition: getting funded or not, commercializing a product or not, developing a technology or losing out to a competitor. In any case it simply provides a means to scale technology and processes.

Universally, small companies want to find talent that meets the standards of their founders who often will hire a wave of direct connections who are known, vetted, loyal and meet their generally high standards. These individuals in turn hire a wave of

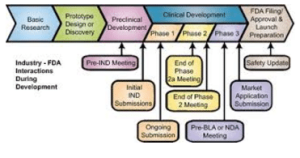

Biopharma (pharmaceutical) is a unique, highly regulated business with lots of quick starts, stops and steep inflection points based on how well a drug performs in the clinic, payer trends, demographics and competitive therapies and technologies.

For most emerging biotechs, the talent gap game plan is to recruit experienced candidates out of global pharma companies by giving them a bigger title and a sizable chunk of Pre-IPO equity. The operative word here is recruit as many of these individuals are well paid and in relatively low risk positions so you need a compelling story, and a position with both upside responsibility and compensation to match the perceived risk.

Inevitably, there will be a need for some recruiting services but the extent of this depends on a company’s hiring volume, timeline, budget and penchant for HR girth. For most well established companies having a full complement of HR makes sense but it quickly follows the law of diminishing returns for smaller companies when it expands beyond a well rounded core. This is to say that for small, pre-commercial biotechs, it just doesn’t make sense to hire regular, full time (FTE) employees in specialized HR roles like recruiting (Talent Acquisition TA in modern parlance) How much this of function needs to be rented(outsourced) vs bought(insourced)? This is the question and below are synopses of the various recruiting service options along with their dis/advantages and general costs.

(1)Build Your Own Pharmaceutical & Biotech Recruiting Team: Let’s define a baseline recruiting team

Building such a team is a noble and logical option that demonstrates to others that your company is driven to succeed and that you plan on standing the test of time. With this approach there will be a delay in business service as you source, screen and hire your regular, full-time (FTE) recruiting team.There will also be an initial service lag as each of the individual hired acclimates to his or her job.

The benefit here is that you will have a dedicated, loyal team that can (hopefully) be counted on to commit themselves to the task of expanding the workforce. The drawbacks of this approach are the cost and the level of employer commitment needed. You will also inevitably pay more and it will take longer with this approach as salaried, benefited employees often get bogged down with internal initiatives that take them away from the task of recruiting. Some of the people who work in corporate recruiting roles take these positions because they are comfortable, benefited roles that garner respect. Still others choose these roles because a corporate recruiting gig is just plain easier than trying to hang your own recruiting shingle. Many of the corporate recruiter types are not hunters and will rely onpost-and-pray or agency management recruiting strategies, choosing HR process over discovering talent.

With the Build Your Own approach comes the employer commitment of finding, managing, developing and equipping these people with the resources they need to be successful and in the end if hiring slows(and for most companies, it will)or they aren’t meeting your standards, you will be paying for a service your don’t need then comes the prospect of layoffs and severance.

Cost: a good experienced recruiter in the Boston area focusing on pharmaceutical and biopharma will start at $125k and on the high end go to $200k. Someone leading a TA function may command a price of $175-$250k. Coordinators, $45k/year, Sourcer, $50-80/hr(part time)

2)On Site Recruitment Contractors this is a frequently chosen approach as it provides companies

Contract Recruiter

with greater flexibility and often produces faster results than hiring FTEs, the hiring of which is more time consuming and energy intensive. You can often find talented, very capable, hired gun contractors who prefer the premium pay over a lower paying (but benefited) FTE, corporate recruiting role. Recruiting consultants should technically work on their own clock and can take on projects from simple staff augmentation all the way through managing a team in a full-cycle and development of recruitment process role. A typical engagement instance would be for a new wave of approved positions ,a new drug program or a new round of venture funding and subsequent headcount re-forecast but it could just as easily be to help put an over-taxed team taking on a few requisitions.

The cost is similar to that of building your own in the short run but generally less expensive in the long run as there is no long term-benefit(LTI) burden and it is easy to end these contracts if the recruitment slows.

There are a few drawbacks: the quality of service is highly variable and the team assembled isn’t usually focused on long term success but rather short term deliverables. Many will require the structure, support, subscriptions and resources of an FTE. Additionally, contractors aren’t wedded to a given company and will often continually look for their next gig(a necessary evil for most) and if they find a better gig, they could bail on you mid project. Some of these recruiters are serial contractors who like to go in and ramp-up a company and then leave once the hiring slows. Yet others are displaced corporate recruiters looking for their next corporate role in the same sort of try-before-you-buy option you would utilize for any contractor that you are considering as an employee.

The typical way of employing these individuals is via agency although, some hired-guns will have their own LLC or incorporation. Resist the temptation of 1099 “ing” contractors unless they pass the independent contractor test. It’s just not worth the risk.

Costs: Agency Recruiter with Markup: $100-150/hr, Coordinator: $35-45/hr, Sourcer, $50-80/hr.

3) Recruitment Process Outsourcing(RPO) This buzz phrase is simply a business process

We at Sci.bio think that the RPO approach is something of a sweet spot especially for smaller and emerging life science companies that will require additional funding or are pre-commercial in their product development but need a turnkey solution quickly and don’t have the time, patience or expertise to develop one in house. Like Contract Recruiters they are hired guns but in a corp to corp , pre-packaged, team capacity. There are frequently back end resources included(equipment, sourcing structure), and often a ATS to leverage. Flexibility and cost are oft cited factors in choosing this approach and strong RPO partners can also offer process improvement along with the transactional recruiting support. The pitch for these firms to small biotechs a pharmaceuticals is that talent acquisition is not your core business, it’s a means to advance your platform or develop your drug. This approach avoids the distraction of having to hire FTEs or manage contractors and this allows you to focus on your technology platform or drug development program. Employees who work in RPO arrangements appreciate the flexibility and the available shared resources that you don’t get when you are a solo contractor.

A company should approach the hiring of one of these firms with the same rigor as hiring a contract recruiting team as there is a lot of variation in this segment and it is rapidly evolving. Some of the bigger players in this market don’t offer much customization and lack speed. This makes more of a vendor management agent especially in the case of hiring contractors where they centralize the process.. The boutique firms are the better play for biotechs as they can customize effectively. In some cases they may lack scalability which a prime reason to choose this option.

Costs: Management Fee Model: can be a monthly or weekly fee or hourly consulting – A fee is paid to the RPO provider for working on an agreed-upon number of positions. The fee may change depending on the agreement, or may have escalation factors if the number of hires increases over a period of time.

Cost Per Hire Model: A fee is paid for each candidate who is successfully brought through the program and hired (or other action such as offered a position) by the customer.

Management Fee Plus Cost Per Hire – This is a combination of the above two. This combines the consistent recruiting effort under the management fee, with payments for the success (hires) of the program.

Cost Per Slate – This is a sourcing model where the RPO provider charges a fee for a set number of sourced, screened and qualified candidates for each open position. From there, the candidates are provided to the internal recruiters for continuation of the recruiting and hiring processes.

Cost Per Transaction – A fee is charged for a specific process to be completed by the RPO provider, such as initial screening or reference checks.

4) Sourcers/Researchers. These individuals should be considered as an augment to any recruiting team in the pharmaceutical industry. I am including them in their own segment because for some very early, and pre-funded companies where the hiring manager is also the recruiter and these individuals will identify potentially suitable candidates at other companies and make comprehensive prospect lists.

I consider it ‘ a must’ that biotechnology recruiters have the ability to effectively source candidates on their own, however, when volume becomes an issue sourcers can keep prospects flowing for slow moving positions and allow biotech recruiters to be more focused on candidate engagement. Some sourcers will do initial engagement but most will be focused on prospect lists using an array of search tools, boolean strings and database queries. We at Sci.bio use them prodigiously as part of our front and back-end services. We especially appreciate those individuals who have been trained in an AIRS like program and who have a good industry understanding.

While these individuals can be used as part of any life science recruitment strategy you would be less inclined to use them on Pay-Per Search Options, below. In almost any situation for an emerging company this person would be hired as a consultant or a contractor and will often serve several clients at a time.

Cost: With Agency Markup, $50-80/hr Some specialized sourcers can command as much as $150 per hour and will claim the same end cost as lower priced sourcers as they are more efficient and knowledgeable. Do your references…

Pay Per Search Options:

5) Retained Search These client-paid individuals consist of third-party

In more established companies the evolved organizational structure may define the needs more clearly and these firms can more easily go “fetch.” What do these firms do differently from say contingency search (my next topic ) or RPO? They are only focusing on one role at a time and they often put more time into the role. Many of the pharmaceutical recruiters in this segment are more experienced so theoretically, it should be worth it to pay the premium for important, high-impact leadership roles. This approach is an especially good consideration for confidential searches where an incumbent who is under performing or is a flight risk. The search firm will develop written job specs and a list of companies to be searched for candidates.

Another differentiating factor with a retained option is that once the search begins the firm will be actively managing the process and candidate flow. This will often start with a talent mapping effort and then evolve into active search and close partnership with both the candidate and company with weekly meetings. These firms will usually provide written reports/summaries of the job interviews and impressions of/from the candidate and your people(and they should for what they charge).

Late stage candidates will have their references checked and are often background checked. – this include candidates developed by the company and those generated by the firm and this is my biggest criticism: companies pay a significant bill even when these firms aren’t successful in finding the candidate.

When choosing a retained firm don’t be taken in by their marketing. Check references carefully (and not just the references they give you, unless you are the type who buys a vacuum cleaner from a door-to-door salesman). Too often I see this option

Technology has leveled the playing field and cheapened the barriers to entry with search and vetting talent so you often don’t need to go to this expensive length(My colleagues in this segment won’t like me for saying this). You can and obtain similar results through other other more thrifty options. Don’t get me wrong. This is a must approach for certain positions but it can actually under perform other approaches, mainly because there is no competition once the firm is on retainer. Nevertheless clients often cite the experience, sector knowledge and concierge service as the driving factor for choosing this approach.

Cost These firms generally charge 30- 35% of the actual first year’s cash compensation for the position (base and bonus). So a position that pays $250k and 25% bonus ($332,000) total comp) bonus would command a total fee about $110,000 of which 1/3 is paid when you retain the firm, 1/3 after thirty days and the balance after sixty days or sometimes upon placement.. You will also be billed for expenses- most search firms want to control the payment of such things as air fare and hotel for candidates. These expenses might average $800 to $1,000 or more per month. Many searches are concluded within 90 days of initiation.

6) Contingency Recruitment Contingency search firms can substitute for retained search in many instances. Unlike retained search firms, companies pay only when they “place” the individual. In other words, there is limited financial risk

These firms may use the tactic of marketing placeable candidates by shopping them around to multiple clients with similar position needs in order to make a placement. This strategy can pit one company against another, a dirty recruiting trick but one good for their business. This won’t happen with a retained firm as once they are on retainer they are committed to that client for the duration of the search. It is however quite plausible that a retained firm will try to pick up another client with a similar position need near the end of a position cycle since they have generated similar, placeable candidates and can easily pivot their candidates onto a new role.

You will want options 1,2 or 3 in place and service is spotty with these firms since they are technically not working for you but rather, generating partially vetted, placeable candidates that would be interested in your job.

Contingency recruiters in biopharma will often ask for an exclusive period to work on a job without competition from another contingency firm. It’s a good idea to start with one good firm and if the results are not up to par then invite another firm to the search after a few weeks. Some firms will lose the incentive to work on a position if there is too much competition.

Contingency Pharmaceutical Recruiters typically charge 20-25% of the first year cash base compensation(excluding bonus). Payable upon candidate placement. The Co-tainer or Co-tingency model hybridizes the retained with contingency and a fee is paid up front(generally one third of the total fee) with the rest paid upon placement.

7) Contract Staffing (Temp Firms)This is usually takes the form of a interim workers who are employed by or through a staffing company – but works on site and is supervised on a day-to-day basis by that firm’s client. Finding good vendors in this category

These firms can be lifesavers when you need a quick pair of hands in the lab or a receptionist in short order but don’t expect extensive vetting/assessment. There are some some senior roles that lend themselves nicely to contract work, for instance those that require project management for a build-out or software developers needed for an upgrade.

You can leverage these firms in instances of industry post docs, internships(co-ops), consultants or any instance that is project based or meant to fill a gap for example a sick leave or resignation. You will find a good percentage of these employees will vie for FTE roles as contractor conversions.

Costs: Typical markup for contractors that are sourced(found) by these firms is 1.45x-1.75x pay rate of the contractor. This of course includes all withholdings, worker’s compensation insurance and liability insurance(burden). For a pay-rolled contractor(one that you find and put through the agency) Here in MA, a typical cost would be 1.25x-1.45x pay rate depending upon whether they require health care insurance. For sourced candidates there is often a fee to convert them to a FTE. Some firms charge their clients if said conversion takes place before 6 months of contractual service.

Regardless of your approach, it is a good idea to benchmark the overall effectiveness of your TA Program. Your “ time to hire” and “cost per hire”, hiring manager satisfaction surveys and Recruiter-to-open-position ratios for instance are good health indicators of your TA program. These data points become valuable when you consider in aggregate: the costs required to replace,train and develop new employees. Having a competitive Talent Acquisition program builds on itself and adds to the overall health of your company.

In the end, you have lots of choices and all TA programs will evolve over time but as a small biotech this function may in fact touch more individuals than almost any segment of the company so invest wisely as many candidates will only get to know you through this service interface for better or for worse.

References

http://web.mit.edu/e-club/hadzima/the-costs-of-hunting-heads.html

https://hbr.org/2015/07/people-before-strategy-a-new-role-for-the-chro