There are plenty of good reasons for Biotechnology and Pharmaceutical companies hiring contractors (Independent Contractors) versus hiring employees to meet company objectives. Here are just a few: lack of funding, clinical failure, and scarce talent in niche areas. These factors create a fertile and lucrative landscape for qualified independent contractors. Clinical Development, Regulatory, and CMC business segments face some of the stiffest competition for talent. So it’s no surprise that they turn to ICs to fill expertise and workforce gaps. In 2022, there were over 70 million ICs in the US and a mind-boggling 1.4 billion worldwide. But many companies have learned the hard way that there are hidden risks in engaging “1099 workers.” Misclassification and other payroll pitfalls can lead to stiff penalties, fines, and even legal action. In the first part of this article, we’ll consider the basic choices employers face when engaging talents, and the pros and cons of each alternative.

Part One: Pros and Cons of Engaging 1099 Contractors vs. Hiring W2 Employees

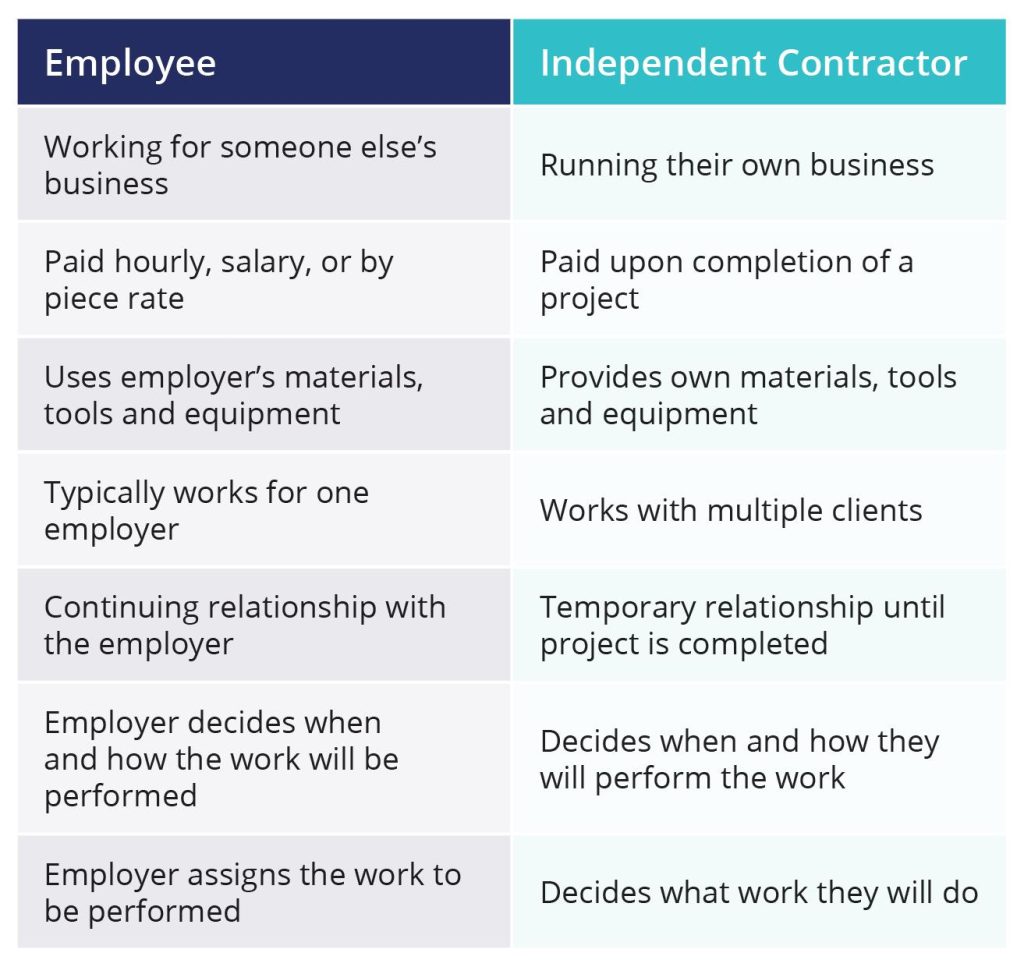

In the view of the US government, labor, and tax authorities, ICs are more like external vendors than internal employees. They are expected to work independently, providing their own tools and resources. They are responsible for their own paperwork and taxes. The IRS tax form that companies use for engaging ICs is what gives “1099 workers” their name. But the government makes clear that ICs must meet strict criteria, highlighted in the table below, guiding employers to take care not to misclassify a worker e as an independent contractor when they should be an employee.

At First Glance, Engaging 1099 Contractors is Easier and Costs Less

It may be tempting for employers to engage independent contractors as a quick, low hassle means of filling skill or labor gaps. Many online apps, marketplaces, and platforms have arisen to expedite the process. Clearly there are compelling reasons for a company to engage ICs:

- Lower Insurance obligations and liabilities

- Ineligibility of ICs for costly company benefits

- Easier termination and offboarding process

- Simpler tax reporting

- Less HR hassle: reduced onboarding, training, and evaluation burdens

The attractiveness and ease of taking the 1099 route has led to widespread use and, sometimes, abuse. It has also attracted more scrutiny and audits, with the IRS focusing on misclassification or, more harshly, “payroll fraud.” The growing volume of IC engagement, and the rising price of getting it wrong, has made efficient and cost-effective management of many such contractors more difficult, and at the same time absolutely essential.

Hidden Risks and Costs When Engaging 1099 Workers

Despite the cost savings and conveniences of engaging ICs, there are strict limitations on when and how employers can exercise this option legally. There are disadvantages and risks in taking this route, which may be unforeseen. Improper usage, whether inadvertently or intentionally, can lead to stiff fines, penalties and/or legal action.

Limited control over independent contractors

Companies have less control over independent contractors.1099 workers are not obliged to work according to company practices and policies. They act as they see fit, at least within their contractual terms. In practice, this can result in breaches and behavior inconsistent with employer norms potentially leading to reputational damage and even lawsuits. In general, the company has less leverage to elicit behavior or work product beyond the strict confines of the contract.

Complicated ownership of work and intellectual property

Companies also have less control over the contract worker’s output and inventions. When an employee creates, writes, or invents something while employed by the business, the company generally owns all rights to that product or idea. But if the 1099 worker makes a product or discovers a better method, they own the rights, unless the hiring company explicitly clarifies ownership and intellectual property issues contractually. This can add complications, costs, and hassle. This is a nuanced area that may require consultation from experts in this specialty.

Competition and potential exposure of company or trade secrets

Employees may be legally bound in their employment contracts and/or applicable law to protect company secrets. The company can require employees not to moonlight or work for a competitor. With 1099 workers, however, there is less loyalty, less control over secrets, and less ability to restrict concurrent or subsequent work for a competitor. While non-disclosure and non-compete agreements (if they do not undermine the IC classification) can reduce the risk, control over independent contractors is far less than over employees. Even unintentional classification mistakes can result in liabilities, penalties, and unforeseen costs. Worse: the intellectual property, competitive and reputational risks of 1099 workers can dwarf savings of time and money, especially for firms in tech, life sciences, biomedical and pharma. In Part Two, we’ll look at steps companies can take to reduce risks and costs, increasing recruitment efficiency and improving management of their independent contractors. Consider Sci.bio as a reliable and cost-effective resource for finding and managing Independent Contractors for your organization. We can efficiently find and deliver high caliber expert consultants for virtually any biopharma segment so you can focus on your business and avoid compliance and payroll headaches associated with hiring ICs. Want to learn more? Contact us today.

Part 2: Optimizing the Engagement and Management of 1099 Workers

For most organizations, small and large, recruitment and ongoing management of human resources is not an either/or choice between employees hired with a W-2 form and engagement of independent contractors (ICs) with a 1099. Similar choices face business in other jurisdictions. In Part One, we looked at the pros and cons of engaging ICs in place of full-time employees. However, in practice, there is a spectrum of nuanced alternatives which strike a balance between hiring employees as opposed to engaging 1099 workers. Here, in Part Two, we’ll consider options for achieving “the best of both worlds.”

Is Hiring Direct Fixed-term Employees Truly a “Middle Ground”?

One “middle ground” alternative used by some companies to mitigate risks and costs of long-term commitments to W-2 employees is to hire such workers on a fixed-term rather than open-ended basis. This is often done when filling temporary personnel gaps due to pregnancy, parental leave, employee sickness/injury, or for staffing up a project with a predictable duration. But more and more companies are taking this route without these circumstances. Fixed-term W-2 employment can be a tempting and less risky alternative to engaging ICs, allowing an employer to exercise more control over workers without incurring long-term obligations. As is well known, the costs to a company of open-ended, long-term employment involves a variety of risks and costs. Defining the period of employment to shorter, clearly-defined periods can ameliorate at least some of these drawbacks and cumulative expenses. However, fixed-termers are eligible for the same benefits as non-fixed-term employees. Employers must recruit these employees and then provide onboarding, internal resources, equipment, and treatment equivalent to all other W2 employees. This may amount to 35% or more of a compensation package. Fixed-term employees are often eligible to collect unemployment benefits which also costs the employer. With this in mind, fixed term employment is not a clear solution to temporary or unpredictable staffing needs.

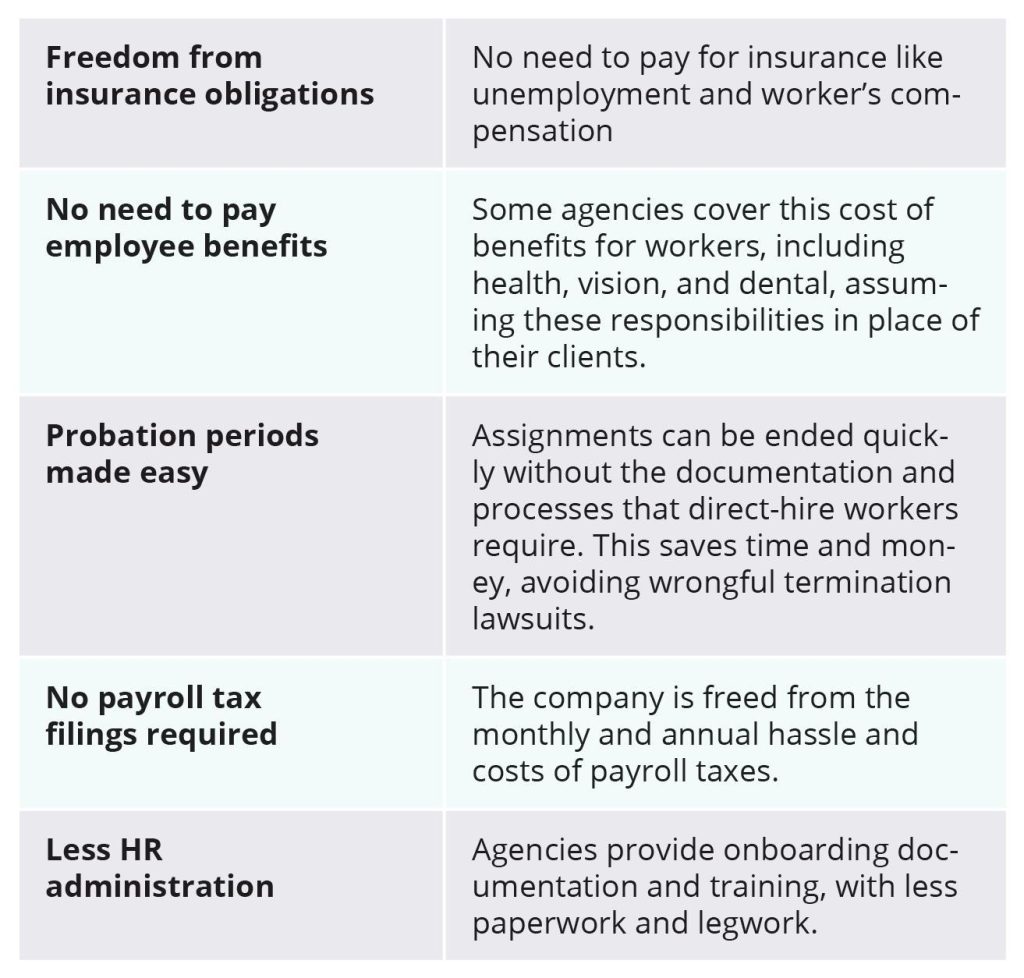

Outsourcing 1099 Worker Management to External Agencies: The Basics

Due to the complexities of recruiting and managing ICs themselves, many firms have sought to mitigate risks, potential complications, and legal entanglements by outsourcing recruitment, contracting, and HR-related management of 1099 workers to external agencies. Such firms can provide a one-stop shop for identifying, recruiting, negotiating and closing employment contracts with specialized workers in their target industries. They offer a streamlined hiring process, including all the documentation needed to get a new IC onboarded. They have the knowledge and expertise to find “best of both worlds” balance in the workforce and relieve their clients of the many hassles and reduce the risks of engaging 1099 workers. Such agencies multiply the benefits of working with independent contractors, providing a management layer of recruitment and HR expertise to reduce risks, cut costs, relieve hassles, and deliver top-flight talent. Of course, there is an added cost for these value-added benefits, usually in the form of a salary markup by the agency. This can be as low as 25-35% for “payrolled individuals” found by the client company and formally hired via the agency. On the high end, markups can be 200% of salary for agencies that have highly technical, ready-to-work experts on call, or who can recruit these specialists fit-for-purpose.

Benefits of Partnering with an Agency to Manage 1099 Workers

The general benefits of working with a 3rd party agency for engaging and managing ICs include:

Choose a 3rd party firm familiar with your industry segment

After making the decision to partner with an external agency to source and manage 1099 contractors, the next steps is to find the one that’s well-suited for you and your industry. This last point is key: working with industry-specialized HR agencies can relieve paperwork burdens and deliver cost-saving benefits, but so can generalist staffing firms. However, the latter are unlikely to have the ready access to the top talent and industry know-how that you require. If they don’t know your niche, they will be hard-pressed to deliver the highest caliber contractors. Far better to seek out a firm which focuses on your industry, with broad and in-depth knowledge of your business and skills ecosystem. This is especially true in biopharma, with its complex niches and business slants. Additionally, biotech and pharmaceutical segments often have unique worker compensation insurance codes that less specialized firms may not know about. Some advantages of partnering with specialized firms:

Cutting Time to Hire

Pharma, medical, and life sciences industries are notorious for their difficulties in sourcing, recruiting, and onboarding suitably qualified employees. Agencies which specialize in these industries know the territory, have the databases and contacts, and know where to look for which skills. They can make it much easier to fill positions and get qualified talent up to speed. So there’s less likelihood of a new contract hire stumbling out of the gate.

Gaining the Perspective and Insight of a Specialized Staffing Agency

By partnering with a staffing agency experienced in your industry, with deep insights about where and how to find talent, you will gain an active ally with specialized know-how about filling a role with a higher quality candidate than you’re likely to find with a generalist firm. Your agency ally should prove to be a go-to partner providing ongoing recruiting and market insights.

Attracting the Highest Quality Consulting Talent: Recruiting Experience Matters

Top-caliber candidates are picky and they can be fickle. Some may not even respond to recruiting from generalist agencies with limited knowledge of “what they do.” Candidates are far more likely to respond to recruiters who possess in-depth domain knowledge and a high reputation for recruitment within their field. Experienced consultants prefer to be represented by a recruitment firm that knows their niche inside and out, who can “walk the talk” with credibility.

Protect Your Brand Reputation with a Staffing Agency That Makes You Look Good

Clients should consider third-party staffing and recruitment firms as an extension of their brands. Partnering with an agency that fails to appreciate or fill their role as your brand steward can have negative consequences in the short-term and the long run. When interviewing candidate agencies, consider the professionalism, integrity and quality of their interactions with you. If their professional self-presentation is anything less than superb. seek out a firm that can represent you in a manner commensurate with your brand values. That will pay big dividends over time.

Conclusion: Seek out a Specialized Agency to Recruit Top Talent

The bottom line is clear. When you’re operating in fiercely competitive industries like biopharma and life sciences, the quality of the people working with you and for you is the key differentiator. While 1099 contractors can provide many advantages over W-2 employees, it is advantageous to seek specialized guidance in recruiting them, hiring them, and managing their contracts. Working with a recruitment and staffing agency specializing in your industry gives you a clear edge in bringing in top talent, increasing contractor quality while reducing your risks and costs. Consider Sci.bio as a reliable and cost-effective resource for finding and managing contractors for your organization. We can efficiently find and deliver high caliber consultants on a contractual basis for virtually any biopharma segment, letting you focus on your business and avoid the compliance and payroll headaches associated with hiring 1099s directly. We are domain life-science domain experts and we’re here to help. Want to learn more? Contact us today.